When retail forex trading became a reality in the nineties, a number of traders emerged as champions of the art form and have gone down in history as major influencers. Bill M. Williams (1932 – 2019) was one of these individuals, who was not only known for his trading prowess in stocks, commodities, and foreign exchange, but also for the many books he authored relating to technical analysis, trading psychology, and chaos theory. He is better known, however, for the many technical indicators that he developed over time to put basic functionality to his proffered theories. One of his favourites was the Alligator Indicator, introduced in 1995, which conjured up the notion of open jaws and feeding time as a way to optimize market entry positions. Gaining an edge in the market is often said to be the proven way to be successful in the forex market, and technical indicators are the tools of the trade.

The Alligator forex indicator is a respected tool in the forex trader’s toolbox. It is a standard offering in most every trading platform, including MetaTrader 4 (MT4) and others proprietary systems, as well. The Alligator is as much a metaphor as it is an indicator. It consists of three lines, overlaid on a pricing chart, that represent the jaw, the teeth and the lips of the beast, and was created to help the trader confirm the presence of a trend and its direction.

The traits or behaviour characteristics of the Alligator are numerous. They typically fall into four distinct phases:

- If the three lines are flat and entwined, then the Alligator’s mouth is closed and he is said to be sleeping.

- As he sleeps, he gets hungrier by the minute, waiting for a breakout from his slumber when he will eat.

- When the trend takes shape, the Alligator wakes and starts eating.

- Once satiated, the Alligator closes his mouth once again and goes to sleep.

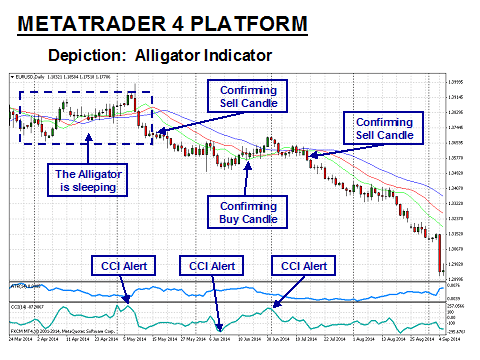

The Alligator indicator can also help traders designate impulse and corrective wave formations, but the tool works best when combined with a momentum indicator. In the example to follow, the Commodity Channel Index (CCI) is used for this purpose. The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are also two popular momentum indicators, designed to measure the strength or weakness of current pricing behaviour.

No indicator is foolproof. False positive signals are a reality, and since the Alligator is a lagging signal creator based on simple moving averages, it is always best to confirm entry points by using other methods, either another indicator, pattern recognition, or perceived levels of strength and resistance. In summary, the Alligator indicator does help the trader stay in the position for a longer period. Williams also developed a “Gator” histogram indicator to help visually with its interpretation and provide another means of validation.

HOW IS THE ALLIGATOR INDICATOR CALCULATED?

The Alligator indicator is common on Metatrader4 trading software, and the calculation formula sequence involves these straightforward steps:

- The Alligator’s Jaw, the “Blue” line in the diagram below, is a 13-period Smoothed Moving Average, moved into the future by 8 bars.

- The Alligator’s Teeth, the “Red” line, is an 8-period Smoothed Moving Average, moved by 5 bars into the future.

- The Alligator’s Lips, the “Green” line, is a 5-period Smoothed Moving Average, moved by 3 bars into the future.

In other words, the Alligator is sensitive to the various crossings of differently timed moving averages. Williams concluded that his indicator helped the trader to “keep his powder dry” until the opportune moment to go into attack mode, in much the same fashion as an alligator that takes its time to size up an opportunity before it swiftly strikes at its prey.

The actual calculations specify the totaling of closing prices over the representative periods, noted above as 13, 8, and 5, which are then shifted forward on the chart between 3 to 8 time periods. The results are alternated over varying timeframes to produce the Jaw, Teeth, and Lips. Software programs perform the necessary computational work and produce an Alligator indicator as displayed in the following annotated chart:

In the example above, the “Jaw”, “Teeth”, and “Lips” are shown for both downtrend and uptrend movements, as the EUR gyrates versus the USD. When the green and red lines above cross the blue line, it is regarded as a sell signal, and vice-versa. Note the two downtrend occurrences of this crossing signal, each preceding a downward fall in price behavior. The Alligator is shifted forward to anticipate a change in direction and visually appears a few bars beyond current price movements. The confirmations from the CCI, in these examples, occur in the current time period.

The weakness in the indicator is that timing may lag due to its future positioning, the reason for attaching a momentum indicator to anticipate the Alligator’s signal. The CCI alerts signaled overbought or oversold conditions for each occasion. Candlesticks also provide additional insights into what the expectations of the market might be going forward.

HOW TO USE THE ALLIGATOR INDICATOR IN FOREX TRADING

Statistics have shown that forex markets tend to be stuck in tight ranging periods from 70% to 80% of the time, but the objective of the trader is to profit when prices break out of those tight boundary conditions and form a new trend. The trend is always your friend, and the way to consistently win in this venue is to be patient and then ride a trend for all it is worth. In other words, patience is required until opportunities arise during the 20% to 30% trending periods. [F]

The Alligator is one technical tool that metaphorically “sleeps” during ranging periods, and then awakens quickly to feed voraciously, as per the example depicted above. The Alligator indicator, with a period settings of “13, 8, 5” and shift settings of “8, 5, 3”, is presented in combination with the candlesticks on the above “Daily” chart for the “EUR/USD” currency pair.

In the example above, the “Blue” line is the Alligator’s jaw, the “Red”, his teeth, and the “Green”, his lips. The “CCI” indicator, or “Aqua” line, has been added to assist in reading the signals generated. One must remember that the Alligator, since it consists of moving average crossovers and is shifted ahead, will lag more than the CCI. The CCI will send the first alert, followed by the Alligator crossover and a closing candle above or below the three moving averages (See the various annotations in the diagram).

The key points of reference are when the lines are entwined, when they are “open”, and when the lines cross. When entwined, the Alligator is said to be sleeping. Patience is the message given here. When the lines are apart, the Alligator is eating. Stay in the trade as long as the candlesticks ride above or below the Alligator. When the lines converge or cross, it is time to consider entering or exiting, although a momentum indicator will fix a better exit point. Traders are also attentive to closing Candles. In the above example, an exit signal occurs when a Candle closes above the center Red line or teeth of the Alligator. During the second downward move, the Alligator, for this reason, would have kept you in the trade a little while longer for more profit.