The Average Directional Movement Index or “ADX” indicator is a member of the Trend family of technical indicators. J. Welles Wilder created the ADX in 1978 to complement his other creative efforts in technical analysis by measuring the strength of trend forces. Traders use the index to determine if a trend will extend or gradually lose its strength; valuable information when setting entry and exit levels in the forex market.

Are you interested in learning about the unique properties of the ADX indicator system? In the following paragraphs, we will illustrate the computations behind this unique technical tool, how it can be used in forex trading, how it can be incorporated into a simple trading strategy within your plan, and, lastly, by reviewing a real-time forex trading example of how it can help you to improve your investments.

John Wilder was one of the foremost leaders in the field of technical analysis. Born in Norris, Texas, this American legend first acquired a degree in Mechanical Engineering, then chose real estate development as a career, and finally followed his true passion by developing a series of popular technical indicators that have stood the test of time. Forex traders know him for his breakthrough creations, like the Relative Strength Index (RSI), the Parabolic SAR, the Average True Range indicator (ATR), and, lastly, the Average Directional Index (ADX). His 1978 book, New Concepts in Technical Trading Systems, remains a key sourcebook in the trading industry.

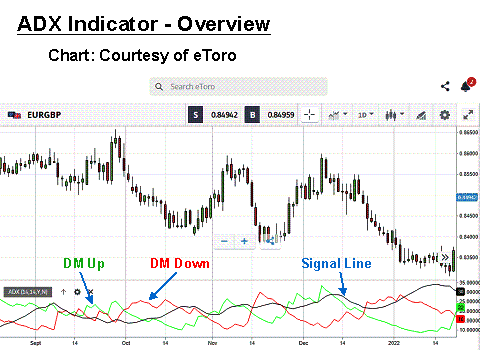

The ADX can also be classified as an oscillator since the various curves within the indicator box fluctuate between zero and 100. The “signal” line of the indicator rarely goes above 60, but values below 25 indicate a weak trend, and values from 25 to 50 suggest a strong one. This indicator consists of three lines, one each for measuring descending and ascending trends, referred to as “DM” or Directional Movement lines, and then a Signal line representing the absolute force of the net ascending and the descending trend.

The Average Directional Index is all about measuring the strength of a trend by breaking it down into its components and parts, either up or down forces. By combining these inputs and arriving at a Signal line, the trader can gauge the direction and momentum of the present price action, a major key in developing winning trading strategies. The ADX, like all indicators, is capable of false-positive alerts from time to time. Correctly interpreting the signals of the ADX indicator requires practice on a demo system, and it works best when combined with other indicators.

HOW IS THE ADX INDICATOR CALCULATED?

The ADX indicator is available on Metatrader4 trading software, and its rather complex calculation sequence involves the following general computations:

- Positive and negative DM indicators are developed based on the previous period’s high/low values.

- An Average DM for N periods is calculated for positive and negative trends.

- Each Average DM is normalised by dividing it by the “Average True Range” (ATR), another indicator, to arrive at two independent indexes.

- A directional Signal index is computed as an absolute value per cent of the difference between the two DM’s divided by their sum.

- Lastly, a moving average of the Directional Index is calculated for N periods.

Wilder was known for his trading systems, which incorporated his innovative indicators. As noted in the above steps, the ATR performs a role in producing both the DM Up and DM Down lines. Software programs on today’s trading platforms perform the necessary computational work instantly and produce an ADX indicator, as displayed in the bottom portion of the previous overview chart.

The ADX indicator will typically have three lines of differing colours. In the example above, the “Black” line is the ADX Signal line, while the “Green” line represents ascending directional movement and the “Red” line, the descending DM. The values for each of the three lines of the ADX are always absolute. They are always positive, never negative. The ADX does not necessarily indicate that a reversal is imminent. Other oscillators are better suited for this purpose, but it does speak to momentum and directional strength.